Innovative Test and Process Technology Solutions

Backed by decades of engineering expertise and a culture of operational excellence, we solve difficult thermal, mechanical, imaging and electronic challenges for customers worldwide while generating strong cash flow and profits. inTEST’s strategy leverages these strengths to grow organically and through acquisitions with a focus on adding innovative technologies, deeper and broader geographic reach, and target market expansion.

-

Environmental Technologies

Creating and controlling environmental conditions in test, process and storage applications

Learn More -

Process Technologies

Technical expertise and engineered induction heating and image capture solutions for a wide variety of applications

Learn More

Our History

inTEST founded

Initial public offering INTT

Acquired TestDesign – Electrical products

Acquired Temptronic – Thermal products

Acquired Intelogic – Mechanical products

Acquired Sigma Systems – Thermal products

Formed inTEST Thermal Solutions – Combined locations for Sigma Systems and Temptronic

Acquired Thermonics – Thermal products

Formed inTEST EMS Products: Combined electrical and mechanical products for semiconductor test

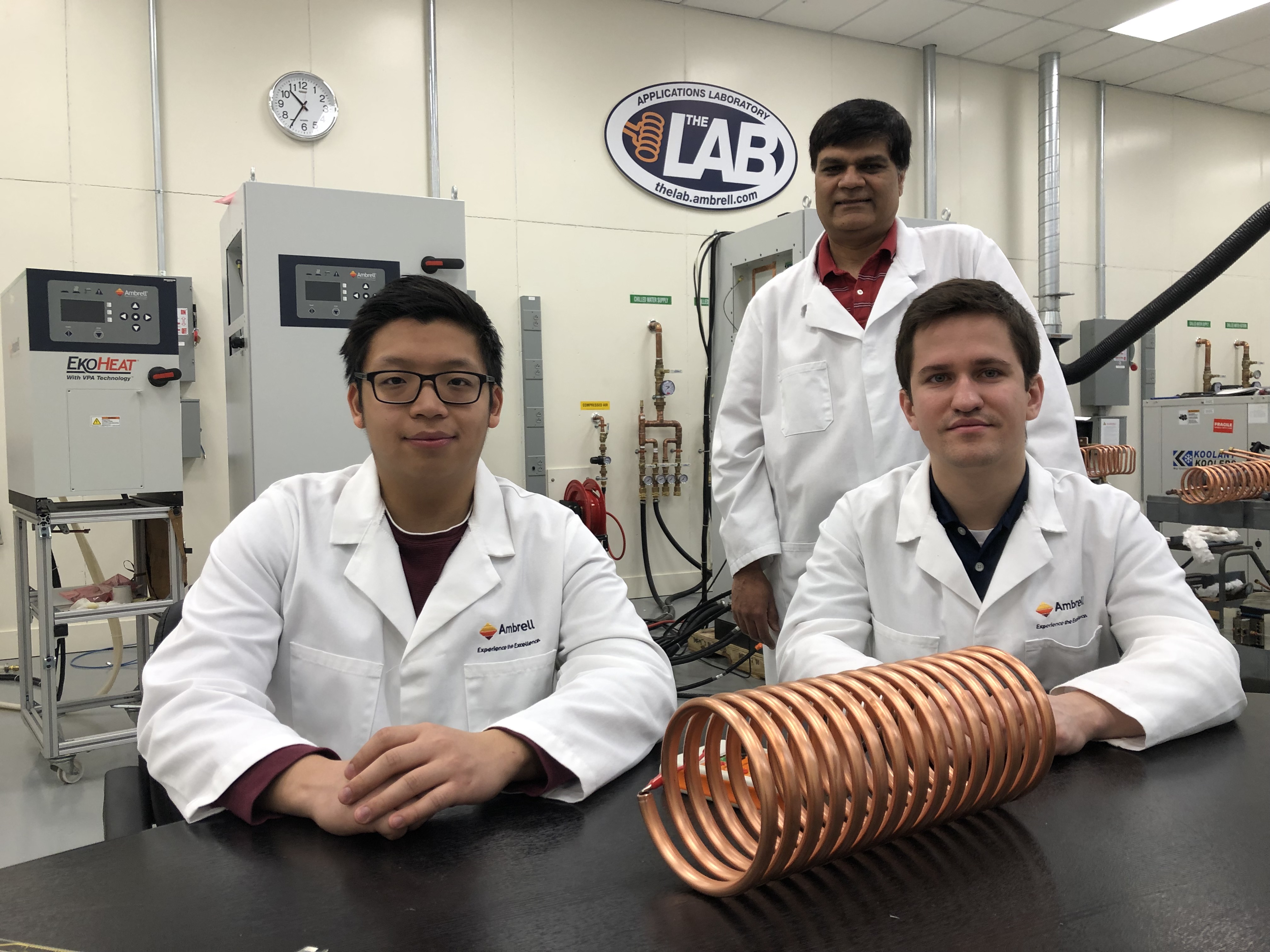

Acquired Ambrell

• Launched 5-Point Strategy to drive growth

• Acquired North Sciences (fka Z-Sciences), Videology Imaging Solutions and Acculogic

Reorganized around three Technology Divisions - Electronic Test, Environmental Technologies and Process Technologies

Acquired Alfamation

Our Future

We launched our 5-Point Strategy early in 2021 and successfully began the effort to accelerate growth, diversify our markets, expand our customer base and add new talent to enhance our team.

Explore (Click on the sections)

Explore (Click on the sections)

Drive Innovation and Technological Differentiation

- Leverage expertise to deliver highly-valued solutions

- Headcount investments to support product development

- Reorganize engineering organization to optimize development

- Drive standardization to increase market availability/lower costs

- Establish Corporate Growth Programs and common stage Gate Development Process

Enhance Service and Support

- Expand geographic service coverage, infrastructure and repair/calibration centers

- Drive enhanced service offerings including third party agreements, extended warranties, preventive maintenance and calibration

- Expand remote services asset health

- Integrate shared field services and repair resources

- Identify and capture recurring revenue stream from service

Foster New Culture and Talent

- Changes driven from top executive leadership

- Emphasize openness, results and accountability

- Drive diversity, engagement and career development

- Leverage collaboration among people and divisions

- Aligned incentives/compensation to results

Pursue Strategic Acquisitions and Partnerships

- Pursue higher frequency of deals

- Key M&A Criteria:

- Expand into faster growing markets

- Offer a broader portfolio of services

- Enhance value-added technological solutions

- Quantifiable achievable synergies

- Explore partnerships with private labelling opportunities; consider JV/partial ownership opportunities

Grow Top-Line Through Geographic and Market Expansion

- Further penetrate existing markets with infrastructure investments

- Expand into new targeted markets with existing products

- Invest in global Direct Sales and Channel Management

- Execute global supply agreements

- Enhance Corporate identity and branding